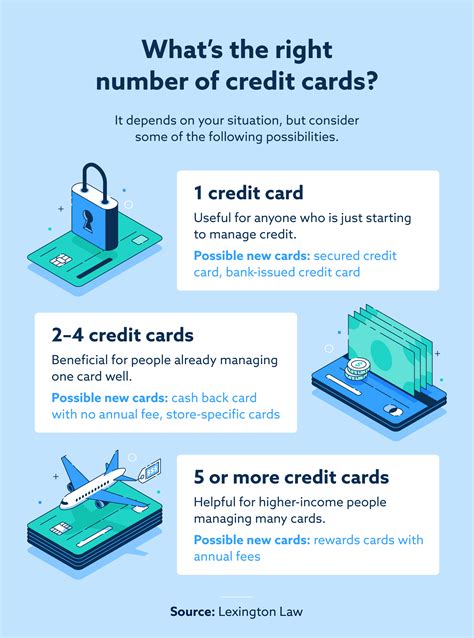

is it smart to have multiple secured credit cards Is It Good To Have Multiple Credit Cards? Any benefit achieved with multiple credit cards ultimately depends on the cardholder and how they manage their finances. Some prefer to live.

The nano SIM card and the memory card have separate slots in the same holder. .

0 · multiple secured cards

1 · multi secured credit cards

2 · how many credit cards to own

3 · how many credit cards should i use

4 · how many credit cards should i carry

5 · how many credit cards should i apply

6 · how many credit cards at once

7 · benefits of multiple credit cards

$27.83

Key takeaways. Holding multiple credit cards won’t necessarily help improve your credit score more quickly in the short-term, compared to having a single card. Opening additional cards can.Key takeaways. Holding multiple credit cards won’t necessarily help improve your credit score more quickly in the short-term, compared to having a single card. Opening additional cards.

Key takeaways. Holding multiple credit cards won’t necessarily help improve your credit score more quickly in the short-term, compared to having a single card. Opening additional cards can.Key takeaways. Holding multiple credit cards won’t necessarily help improve your credit score more quickly in the short-term, compared to having a single card. Opening additional cards.

Some people believe one secured card with a higher limit is better, versus two secured cards with lower limits. The reason for that, is because by having one secured card with a bigger limit, it will help you in getting approved with other creditors with . Is It Good To Have Multiple Credit Cards? Any benefit achieved with multiple credit cards ultimately depends on the cardholder and how they manage their finances. Some prefer to live.

The answer for the most part is probably not. Having two secured credit cards and using them responsibly a a period of time (like six months to a year) is probably the best thing to do once you get your two secured credit cards.Can obtaining multiple secured credit cards raise your credit score faster than just a single secured credit card? Here's the answer.

Having multiple secured credit cards is not necessary to build good credit, and nothing indicates you’ll achieve a good credit score faster by doing so.

Using a secured credit card is perhaps the quickest and easiest way to build credit — as long as you're smart about how you use it. Secured cards are different from regular credit. Forbes Advisor evaluated multiple credit cards to find and rank the best secured credit cards. For each credit card, we collected information that potential cardholders would use in. For many people, the answer is yes. If your credit scores are in good enough shape to get approved for another card, and you use credit responsibly, there are several advantages to having. Key takeaways. Holding multiple credit cards won’t necessarily help improve your credit score more quickly in the short-term, compared to having a single card. Opening additional cards can.

Key takeaways. Holding multiple credit cards won’t necessarily help improve your credit score more quickly in the short-term, compared to having a single card. Opening additional cards.

require windows hello for business or smart card

multiple secured cards

Some people believe one secured card with a higher limit is better, versus two secured cards with lower limits. The reason for that, is because by having one secured card with a bigger limit, it will help you in getting approved with other creditors with . Is It Good To Have Multiple Credit Cards? Any benefit achieved with multiple credit cards ultimately depends on the cardholder and how they manage their finances. Some prefer to live.

The answer for the most part is probably not. Having two secured credit cards and using them responsibly a a period of time (like six months to a year) is probably the best thing to do once you get your two secured credit cards.Can obtaining multiple secured credit cards raise your credit score faster than just a single secured credit card? Here's the answer. Having multiple secured credit cards is not necessary to build good credit, and nothing indicates you’ll achieve a good credit score faster by doing so.

Using a secured credit card is perhaps the quickest and easiest way to build credit — as long as you're smart about how you use it. Secured cards are different from regular credit.

Forbes Advisor evaluated multiple credit cards to find and rank the best secured credit cards. For each credit card, we collected information that potential cardholders would use in.

multi secured credit cards

riconoscimento smart card in corso

Explore a wide range of our Nfc Zelda selection. Find top brands, exclusive offers, and .Some of the bestselling zelda nfc cards available on Etsy are: NOW SHIPPING 4 New .

is it smart to have multiple secured credit cards|benefits of multiple credit cards